35+ Mortgage calculator with condo fees

Listing provided by GLVAR. At the rate of tax is 035 cents per 100 or portion thereof.

Does A 10 Year Fixed Mortgage Finally Make Sense Ratesdotca

Freddie Mac and the National Association of Homebuilders expect mortgage rates to be 3 in 2021 while the National Association of Realtors thinks it will reach 32 and Wells Fargo thinks rates will be 289.

. The rate on the 30-year fixed mortgage increased to 554 from 551 the week prior according to Freddie Mac. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. 750000 or 375000 if married filing separately in 2021 and 2022 for a main residency a second mortgage a line of.

The NYC Mansion Tax consists of 8 individual tax brackets. Monthly mortgage payment calculator See. Our mortgage payment calculator shows you how much youll need to pay each month.

According to Canada Mortgage and Housing Corporation CMHC your monthly housing costs should not be more than about 35 of your gross monthly income. Use SmartAssets free Florida mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. Why Condos are Treated Differently.

In addition to the interest rate and down payment the calculator takes into account the mortgage-interest tax deduction. The average cost of condo insurance is 625 a year or 52 a month. The practice is commonly called Spot Approval in the real estate and mortgage world.

Real estate Its getting expensive to tap record home equity. Condo insurance HO-6 policies cover building property personal property liability and more. In 2010 condominiums had an average price of 484500 in Vancouver.

The lowest rate of 1 applies to purchases at. Biweekly Amortization Schedule. ALTA 41 Condo 25 OPLP.

Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. The Mortgage Bankers Asociations chief economist Mike Fratantoni believes the 30-year fixed rate will reach 33 in 2021 and 36 in 2022. This includes costs such as mortgage payments and utilities.

2 bds 2 ba 1020 sqft - Condo for sale. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D. However given a mortgage applicants credit history lenders are free to adjust the GDS and TDS thresholds within a reasonable range.

For example if you buy a condo you pay monthly condo fees. This refers to approving a loan for one condo unit that is part of a condo project not approved for FHA lending. Home Equity Line of Credit You might be able to use a portion of your homes value to spruce it.

These include mortgage payments condo fees or other. The Mansion Tax in NYC is a progressive buyer closing cost which ranges from 1 to 39 of the purchase price on sales of 1 million or more. Mortgage default insurance.

Best rates in Canada. Compare over 30 lenders and check your mortgage payments. The basic difference between a condo and a normal home deals with the land.

There are pros and cons to owning a condo. INFINITY BROKERAGE Kevin Goujon. Closing costs account for a number of mortgage lender fees also known as origination charges title company fees and.

In 2020 the average price of a condo is now 784000 an over 60 increase in 10 years. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. The CHMC recommends that GDS and TDS thresholds be set to 35 and 42 respectfully.

The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other. The maximum amortization period is 25 years for down payments under 20 and 35 years for higher down payments. Canada-wide mortgage fees and regulations.

Other costs and fees related to your mortgage may increase this number. To pass the stress test and qualify for a mortgage all applicants must be within the GDS and TDS thresholds set by the lender. Payment Date Payment Interest Principal Tax Insurance PMI.

At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 47742 a month while a 15-year might cost 73969 a month. There is no cap on the amount of tax due. See the monthly cost on a 250000 mortgage over 15- or 30-years.

Compare and see which option is better for you after interest fees and rates. See how your monthly payment changes by making updates to. Limitation of Liability for On-Line Calculator The fees produced herein are for informational purposes only based on general circumstances and are provided as-is with all warranties express and implied.

Mortgage interestThis can apply to a regular mortgage up to a certain limit. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. In our Learning Center you can see todays mortgage rates and calculate what you can afford with our mortgage calculator before applying for a mortgage.

You can even compare scenarios for different down payments amounts amortization periods and variable and fixed mortgage rates. However you may like the. This calculator is provided for general information.

The maximum amortization period for all mortgages is 35 years. This average is actually lower than the current average fixed mortgage rate across Canadas Big 5 Banks as of September 8 2022. 3930 University Center Dr 406 Las Vegas NV 89119.

On June 9 2022 the Bank of Canada released a report that predicted that fixed rates will be at an average of about 45 by 2025.

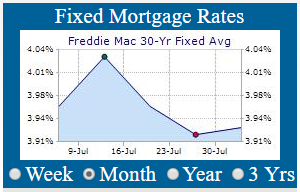

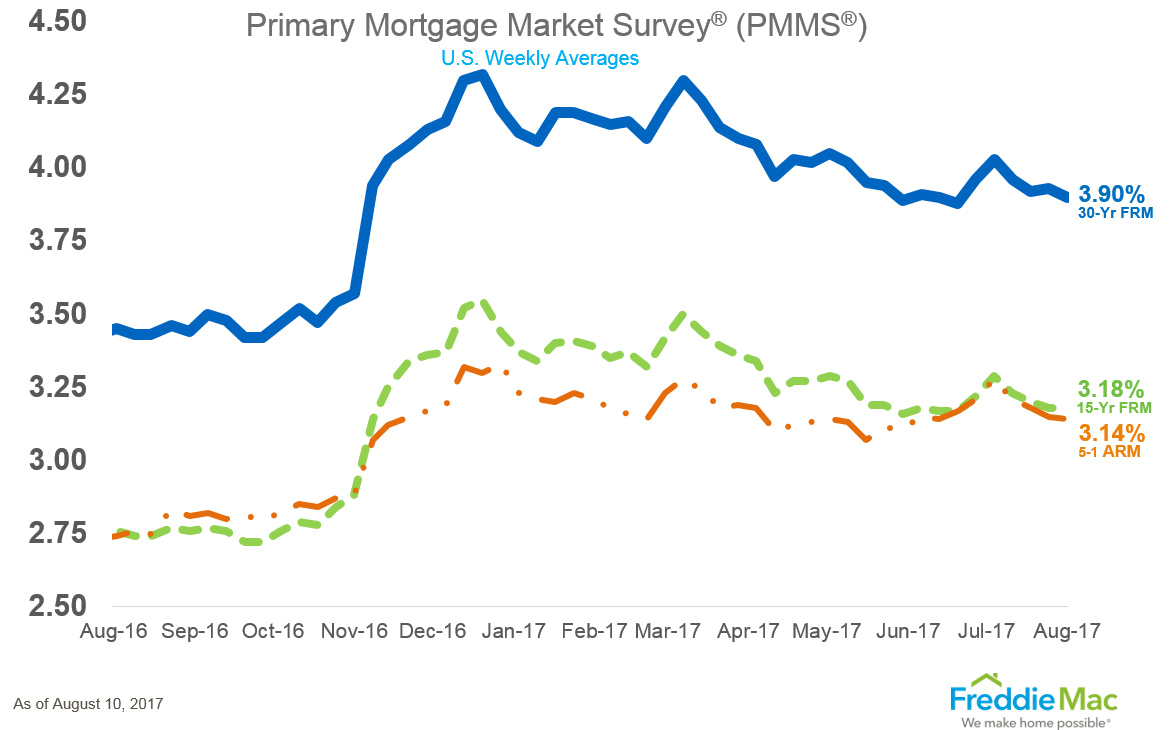

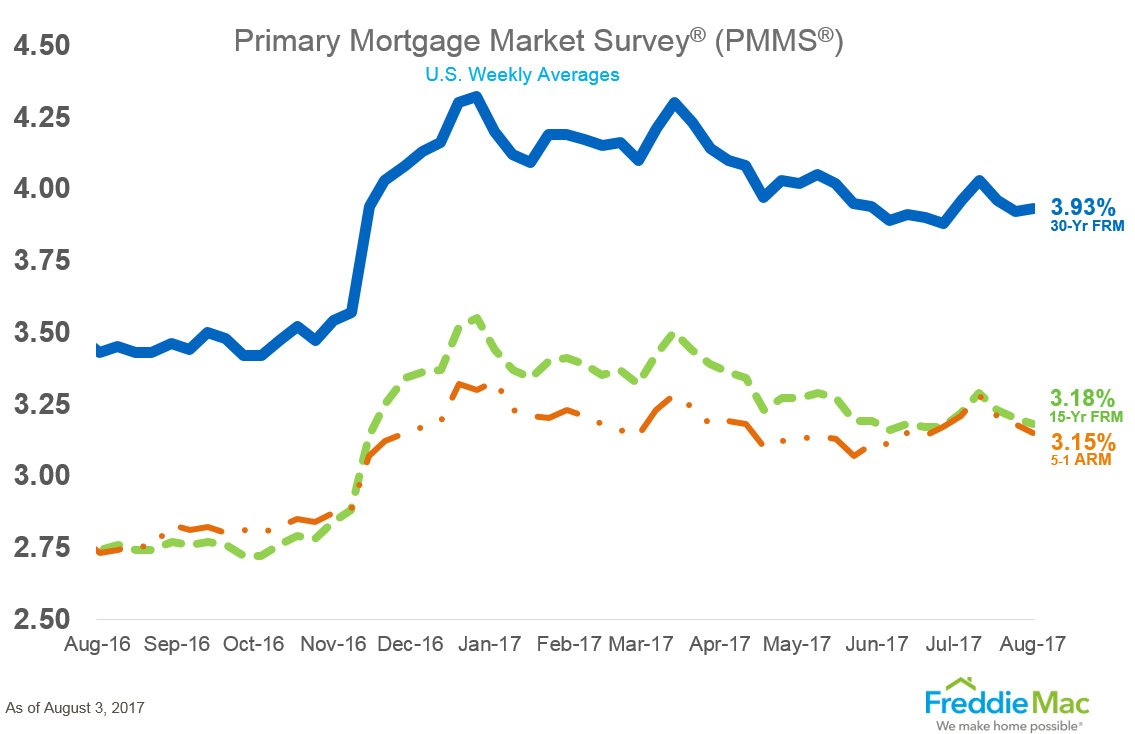

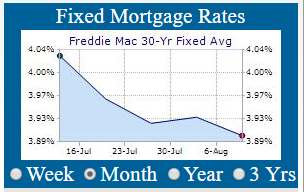

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Pros And Cons Of Adjustable Rate Mortgages Adjustable Rate Mortgage First Time Home Buyers First Home Buyer

820 Oakton Street Unit 4e Evanston Il 60202 Compass

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Pros And Cons Of 15 Year Mortgages Buying First Home First Home Buyer Home Buying Tips

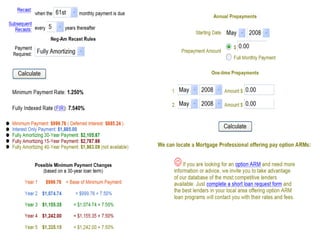

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Mortgage Amortization Calculator

Financial Network Drew S Home Team

Affordability Calculator Andrew Beitler Mba Minnesota My Home

Your Adjustable Rate Mortgage Needs To Be Refinanced

-1.webp)

Who We Are At Amerifirst Home Mortgage The Amerifirst Values

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Four Corners Real Estate Guide By Ballantine Communications Issuu

Is It Just As Easy To Pay For A House In Cash And Then Get A Mortgage Afterwards Quora

Renting Vs Buying A Home Rent Vs Buy Real Estate Tips Getting Into Real Estate

Your Adjustable Rate Mortgage Needs To Be Refinanced

A Main Street Perspective On The Wall Street Mortgage Crisis